Overview

“How to retire early,” or more specifically “How did we retire early?” is the question we get asked the most. People ask this and seem to be looking for a quick simple answer. They want it to be an event, investment, or some single item that we did. For instance, we invested in bitcoin early or something. But that wasn’t us! If you were looking for an easy answer we have to disappoint you.

Maybe even more surprisingly, we did not have the retire early (FIRE) as our ultimate goal until COVID-19 happened. It had been a thought, but not the focus. It wasn’t even until after we told people that we were retiring, that we even learned about the FIRE movement. We were instead always working more on the Financial Independence (FIRE) part of this. The time in 2020 during the COVID lockdown gave us a glimpse of retiring early.

For us, the lockdown time was eye-opening. We spent it together learning and exploring. We hiked and spent so much time outside, while many others felt housebound. The time with the kids and each other was amazing. Obviously, it was tough in many other aspects and for many people. We are not trying in any way to minimize this. But this time gave us an extended look at what an early retirement could be. So given this, we started doing the math. What we learned is that we could sell everything and travel the world. Amazingly, we could do this for roughly half of what we would need to live in the United States!

How to Retire Early List

This is what worked for us as we figured out “How to retire early”:

- For all decisions, we always consider the financial impact

- It was always a consideration, never the sole determining factor

- Knew our shared vision and used this to guide our daily spending decisions

- Spent time to get the big decisions right (house, cars, wedding, and so on)

- Worked hard and smart

- Knew our value and were not afraid to push for what we should be paid

- Delayed gratification especially when it came to material items

- Most of our material items were bought used/second hand

- Spent money on important things (healthy food, time gainers, family vacations)

- Figured things out to save/make money (for example selling our house without a realtor)

- We don’t pay interest (except on our mortgage)

- We let our money work for us to make more money

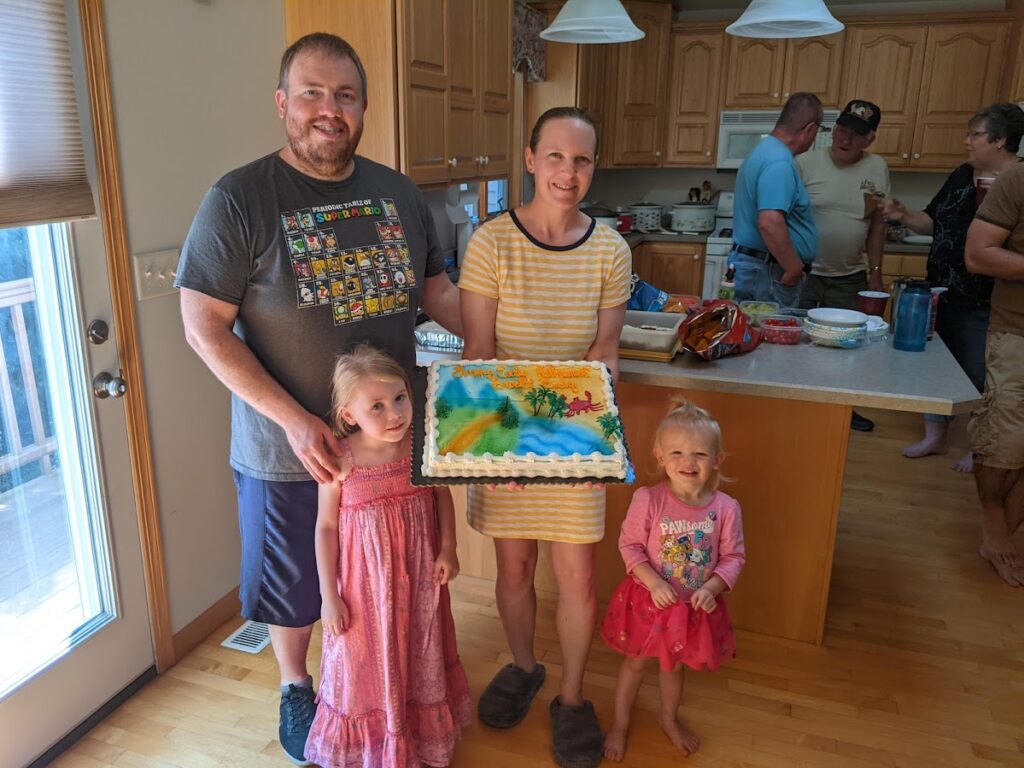

Sounds like a lot of work right? It was, but we also lived while we did it. As we mentioned above, we spent money on what we deemed important. One of those was time as a family. We took one-month family trips every year since we had kids. Although, 2020 was cut short due to COVID. Kyra by the time she was 3 had been on 4 one-month family trips (Hawaii, Sri Lanka, South Africa/Lesotho, and Belize).

When we needed things we always had the money to buy them. For instance, Brock has always spent a lot on computers that he uses daily for work. Becky spent money on important items that clients needed to be comfortable during massages. Examples include premium lotions, sheets, warmers, and pregnancy pillows. The kids have always had the foods that were best for their health and wellness.

The Framework – How to Retire Early

Most people are probably thinking at this point, “How do you know when to spend money and when not to?” A framework is critical when you are thinking about how to retire early. Importantly it helped us to create a shared vision. We used this vision to help us determine our course of action for matters large and small. This shared vision was used for all decisions, not just financial ones.

For us, the following worked well as we worked toward financial independence:

- Learn about how we view money individually and as a couple

- Understand our dreams and communicate as a couple to create a shared vision

- Utilize this shared vision to make all decisions (large and small)

- Communicate about everything financial and revisit steps 1 through 3 frequently

Step 1: Understand Relationships with Money

I have read my share of financial independence articles at this point. I see so much focus on investments and post-retirement plans. Do you know what I never see much about? I don’t see individuals and/or couples learning about how they view money. Thinking about what influences them. Considering what they learned and what they should be learning. Investigating their systems for making financial decisions.

When you add another person, this is amplified. In this article from Marketwatch think about the following:

- Nearly half of Americans (48%) say they argue with their partner in a survey

- Most of those fights are about spending habits, with 60% saying that one person spends too much or the other is too cheap

- In another survey, 41% of divorced Gen Xers and 29% of Boomers say they ended their marriage due to disagreements about money

Wow, it is critically important to get on the same financial page in a relationship! The problem is that people usually only talk about this when they are arguing. For us, we spent time learning about ourselves and each other. We talked about our thought patterns. Together, we tried to see potential problems ahead and talk about how we would handle them. We tried to understand each other’s triggers.

Despite all this work, to this day we have issues when it comes to money. But when you understand each other and are pulling towards the same vision it makes it easier to navigate rough patches and hard decisions.

Step 2: Understand your dreams and create a shared vision

The most important thing to keep you on the path to financial independence is a shared vision of what you are working for. If you need, re-read that sentence, it could be the most important one in this blog post. The shared vision is the “why” you are trying to reach financial independence and/or understand how to retire early.

Financial independence is almost impossible without a truly shared vision. You have to know and believe what you are working towards. The reason is that in the hard times it is too tempting to take the easy way out. This first decision then snowballs. Quickly people see financial independence as something they cannot attain. You have to know what you are working for, and it cannot simply be a number in an account.

Digging deeper it is important to understand your shared vision because you need to live it while you are on the path to financial independence. We truly believe that if we had only focused on the future we would have never been successful in the present or past. The vision must be truly shared. It cannot be one person’s desire, this will not work.

That said the shared vision is fluid and can change over time. But in the end, you need something that is understandable and motivates everyone equally. We found that this is the topic we would revisit every 1 to 3 months. Staying on the same page is vital as life events happen and you change as people/couples. We often discussed this while on walks with the kids around town or on drives to family events.

Step 3: Use shared vision to make all decisions

Creating a shared vision does no good if you do not use it. It is like having a plan that is made and then stored somewhere to never be seen again. The thing is the shared vision should be so simple that it can be recited by each person in the family. You can go on to detail more information as you want. But the core must be easy to understand and remember. Our shared vision put simply was:

- To be fully financially independent and travel

- Have quality time together and with our kids

- Don’t wait until the typical retirement age to live free and fulfill dreams

So many people we know have put off dreams. Many have never been able to fulfill those dreams. Health and so many other things can go wrong. With your shared vision in place can move on to how you spend money. With whatever you create you need to have a template you can use for making financial decisions.

Where to spend no money

For us, we knew that for most material items we would strive to spend nothing. These were things that for us had no value. For us, this includes things like

- tattoos/piercings

- harmful habits (smoking/vaping)

- expensive adult toys (Jet skis/ATVs/boats)

- and so many other items

In these instances, we eliminate spending when it does not match our goals. For example, Becky cut Brock’s hair to save money. We only had the money for the equipment upfront (which was actually a gift). The thing here is that if something is not making your life better, you should try to eliminate it (not reduce it). For each person or couple, these decisions will be different. The important thing is to not let yourself be marketed into these expenses. You do not have to keep up with the Joneses. Life should not be a spending competition.

Where to spend less

When you are trying to understand “how to retire early”, you need to think about where to spend less. These are typically the things you need, but which do not bring meaning to your life. A prime example is clothes. You need clothes, but there is no extra value in a new pair of pants versus a used one. Many times we bought from garage sales or thrift stores to save money instead of buying new. Examples included clothes for the family, kid’s toys, books, family Christmas and Birthday gifts, and more. That said there can be exceptions. For instance, we have paid more for better shoes for Brock because of feet issues he was dealing with.

We always try to be strategic about what we needed for the upcoming year and when it came to birthdays and Christmas. People in the family were encouraged to give items we would have otherwise bought new. We didn’t want clothes or toys that we could get for pennies on the dollar used. Some people in the family do what they want, which is ok. That said, some people might not like this but, we returned many new items that we either didn’t like, the kid’s did not like, or that we could get much cheaper used. We then put that money into the kid’s accounts or used it for something they needed instead.

Where to spend more

But we also had areas where we did our best to economize but decided to spend what was needed because it was important to our shared vision. While the main focus here is on how to retire early, you also need to be in the present as you work toward these long-term goals. Examples include:

- Family travel

- Healthy food and supplements

- Body maintenance (massage, chiropractic, and physical therapy)

- Items for our work (already mentioned above)

- Activities and education for the kids

- Places where we could buy time (house cleaning help/lawn mowing)

This is such an important thing to understand. If you approach financial independence like a starvation diet, you will likely fail and crash hard. In our opinion, when you are trying to figure out “how to retire early” you must make it a path you can sustain. Having areas you spend is important to live in the present and not fixate on a future that might not happen. We feel like fixation on your FIRE number and deprivation to attain it is not healthy or likely to be successful.

Making Large Financial Decisions

For large financial decisions, we spent time making sure we got these right. As an example, when we were getting married, it was widely talked about that the average wedding was costing people $26,000. Becky and I talked about what was more important. Was it to have a huge single-day expensive wedding or to be able to buy a house. We decided before we started planning the wedding that it was to have a house.

As we set up our wedding and reception we understood our goal was to have an amazing day but to do so economically. We offset costs in many ways including trades when possible. For instance, Brock developed a website for the catering company to offset most of the food costs for the reception. In the end, it took a lot of time, but we made money at our wedding. How many people can say that!

For buying cars and a house we did so much research. We looked at different options and created spreadsheets to understand these options. It took time to learn about markets. We didn’t buy “as much house as we could afford.” It was a conscious decision to save our money to buy a house we could live in for years and not a starter home. We set what was important. Emotions or what other people did were not enough to push us into bad decisions.

An interesting side note about how we have tried to improve. The detailed approach for large decisions is important. However, we also tend to overanalyze small financial decisions. The time we were spending was not worth the small amounts we could potentially save. For instance, it makes no sense to spend an hour trying to save $5 on a $50 purchase. Especially when in that same hour Becky or I could work to make at least $60 per hour. We recognized this years ago and have been working to let our vision dictate these small decisions. But truthfully we are a work in progress in this area.

Communicate about everything and revisit steps 1 to 3 often

Most people can set goals and accomplish them in the short term with relative ease. What is tough in life is being consistent over the long term. This is especially true when you are looking at how to retire early. When the vision you have set will take years to happen it can be tough to stay focused. It is also easy to have items become contentious if you are doing this as a couple or family. Communication is critical to this being successful. What we find is that the earlier we communicate about potential issues the better off we are. It is hard to communicate successfully in the heat of the moment.

Additionally, you have to revisit all three steps often. As new spending decisions or income options come up you have to go back to the basics. Think about how your relationship with money is affecting your feelings. And think about how the issue relates to your vision. For instance, a promotion at work that offers little extra compensation and much more responsibility may not be worth it. That is especially true if your goal is more time with the family and less stress in your life.

One important communication tool was to implement a weekly family meeting (usually paired with waffles!). It had a set agenda but also allowed for questions to be asked. Our first point was to discuss two large picture items. One we went through one point from the Habits of Healthy Families book at each meeting (7 total). Secondly, we went through one of the bullet points from our family mission statement each week (8 total). Doing this with each other and the kids helped keep our mission right in front of us. This is important because it is easy to get distracted. So many things are competing for attention as adults/parents. How to retire early has to be a priority.

Conclusion

In reality, this blog post is just scratching the surface of “How to retire early”. As time passes our goal is to revisit this and get more in-depth about the topics mentioned here (and some that we didn’t even talk about). But this should help you get an idea. That said we did try to give some specifics where we thought it would help make items more clear. It is important to realize we did most of the above as we went. What we wrote is how we did this thinking back on it. For us, we just figured it out and always did so together.

For those who are new to us, you can learn more about us starting with our about us page. You can also subscribe to our YouTube channel!

Brock & Becky Waterman

Written: 5/10/2022

Posted: 5/10/2022

Are you traveling now?

Hi Diane: We are currently in Playa del Carmen, Mexico. We came back to Mexico on April 25 and so far we have also spent time in Puerto Morelos and Cozumel. The plan is to be on the road in Meexico until June 3.

I was wondering where you are these days! Love seeing your posts. When you get back “home”, would love to get together and hear more, along with pics of course!

Hi Bev: Thanks for the comment and we can let you know when we are back. Hope things are going well for you 🙂

Pingback: How to Have Successful Life Change Conversations With Family & Friends